The FDA’s Recent Uptick in Ophthalmic NDA & BLA Approvals

Table of Contents

For many years it was believed that the golden age of FDA new drug approvals was behind us. In the late-1990s, the pharmaceutical industry experienced an approval boom, reaching a peak of 50 New Drug Application (NDA) and Biological License Application (BLA) approvals in 19961 (Figure 1). During this time, the FDA was focused on speeding up the drug approval process, motivated by external factors including the AIDS epidemic and increased funding from new legislation. Pharmaceutical companies reaped the benefits as a flood of new drugs hit the market.

The surge could not last, however. The majority of the 21st century has experienced a significant approval plateau, with rising development costs and restrictive regulations dramatically slowing the pharmaceutical pipeline.

That is, until recently.

A New Era in Ophthalmics

In an interesting turn of events, the past two years have proven to be a blockbuster period for new drug and biologic approvals. 2018 saw the approval of a whopping 61 NDAs and BLAs (including two recombinant therapies), exceeding the previous record by over 20%1.

Ophthalmic drug developers in particular have had reason to celebrate. Between 2015 and 2018 an 800% increase was observed in novel ocular drug approvals, generating excitement in the industry as potentially sight-saving therapies progressively hit the market2.

Late 2017 saw the approval of two novel therapies for glaucoma, a debilitating disease that had not received a new treatment option for over twenty years3. Only a few months later, the first ever gene therapy for ophthalmic use was approved to treat mutation-associated retinal dystrophy4. Other exciting approvals include an intravitreal implant for non-infectious uveitis and an injectable suspension for post-operative inflammation2. Table 1 provides further information on these products.

Table 1: Notable Ophthalmic Drug Approvals by the FDA, 2017-2018

| Brand Name | API | Dosage Form | Indications |

|---|---|---|---|

| Rhopressa® | Netarsudil | Ophthalmic Solution | Open-Angle Glaucoma, Ocular Hypertension |

| Vyzulta® | Latanoprostene | Ophthalmic Solution | Open-Angle Glaucoma, Ocular Hypertension |

| Luxturna™* | Voretigene neparvovec-rzyl |

Ophthalmic Suspension | Retinal Dystrophy |

| Yutiq™ | Fluocinolone acetonide | Intravitreal Implant | Chronic Non-infectious Uveitis |

| Dexycu™ | Dexamethasone | Ophthalmic Suspension | Post-operative inflammation |

* First ever FDA-approved gene therapy for ophthalmic use.

So, Why the Uptick?

Several factors have played a role in the approval increase, but the trend can essentially be boiled down to three key components:

- FDA restructuring, streamlining, and shifted approach

- Rise in CDMO usage

- Increased venture capital investments

FDA restructuring, streamlining, and shifted approach

A 2013 study asked CEOs and Board of Directors members of ophthalmic companies what their main obstacles were in bringing new products to market. One of the most highly reported answers was, unsurprisingly, regulatory burden5.

Since then, however, companies are increasingly reporting a newfound openness with FDA philosophy. Agency actions such as allowing for more inventive clinical trial design and surrogate endpoints have eased the approval process6, and former FDA commissioner Scott Gottlieb spoke openly about his desire to streamline the drug approval process prior to being confirmed for the position in 2017. The 21st Century Cures Act, passed in late 2016 with the primary objective of accelerating drug products to market, has also played a significant role in the uptick.

“Between 2015 and 2018 an 800% increase was observed in novel ocular drug approvals.”

Additionally, the FDA restructured the Office of New Drugs several years back to realign where incoming ophthalmic NDAs and BLAs are reviewed7. From this, the Office of Transplant and Ophthalmology Products was born, which likely contributed to the increased FDA productivity with ocular drug products in recent years.

Rise in CDMO usage

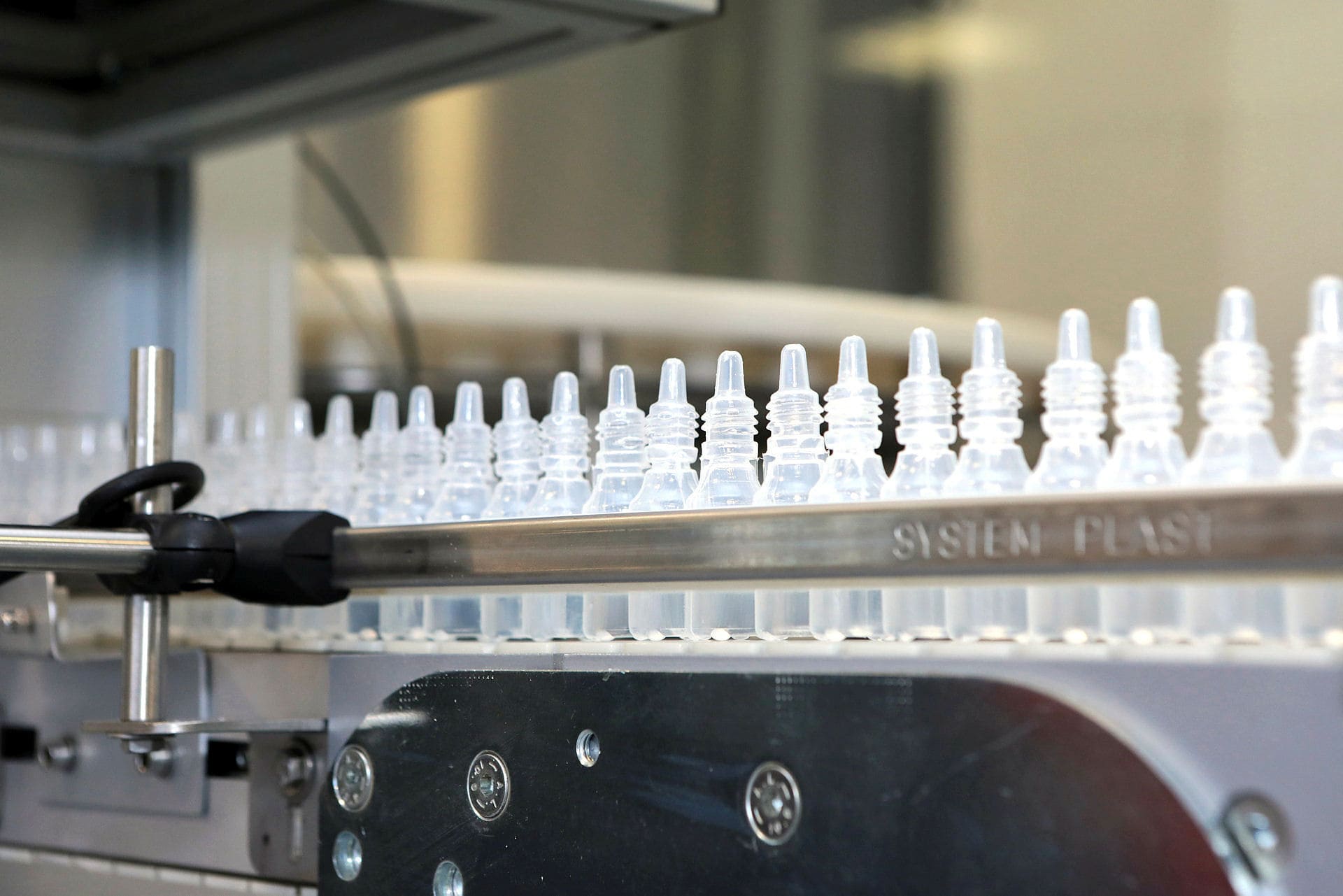

In the early 2000s, with operating costs and liability potential on the rise, the pharmaceutical industry started looking to outsourcing partners. These companies, known as Contract Development and Manufacturing Organizations (CDMOs), offered the attractive potential for lower overall development costs, risk mitigation, and expedition of products to market. As a result, CDMO usage began to rise, and has consistently risen 6-7% year over year ever since – which is uncoincidentally aligned with the build-up to the NDA/BLA approval boom8.

The ophthalmic drug industry in particular has leaned on CDMOs for assistance, more so than other therapeutic areas. This is due to the fact that complex formulations and dosage forms, such as long-acting intravitreal injections and biodegradable ocular implants, have become increasingly prevalent. The advanced expertise and equipment required for these products has made in-house development unlikely. “We’ve seen a huge uptick in companies coming to us for the development and manufacturing of ocular products, so the increase in approvals here comes as no surprise,” says Dr. Robert Lee, President of the Particle Sciences.

Delivery of therapeutics to the human eye is one of the most interesting—but challenging—endeavors a formulator can take on. The anatomy and chemical composition of the eye make it highly resistant to pharmaceutical penetration. Successfully circumventing these protective barriers requires intimate knowledge of ocular delivery as well as specialized development and manufacturing expertise. This webcast will explore solutions to some of today’s most challenging issues in ophthalmic drug delivery including selection of dosage form, options for increasing bioavailability, improving drug stability, properly handling highly potent APIs, overcoming patient compliance issues, and meeting the sterility critical quality attribute.

Increased venture capital investments

Funding has always been one of the biggest concerns for companies when it comes to pharmaceutical development, even more so than regulatory obstacles. The estimated cost of bringing a new drug to market is reported to be somewhere in the several billion-dollar range. Companies often have little choice but to rely heavily on venture capital investments to meet this hefty requirement.

Consequently, it should come as no shock that right around the time of the increase in ophthalmic NDA and BLA approvals, venture capital investments dramatically climbed as well. In 2018 ocular investments amounted to $718 million, compared to just over $200 million just two years prior2 (Figure 3). This seems to have particularly helped start-ups and small virtual companies, which are common candidates for this type of funding. A 2018 study found that the rate of ophthalmic start-ups with a successful product license or exit over a five-year span is now 38%, compared to the 20% reported at the beginning of the study5. The average success rate for the pharmaceutical industry overall was reported as 10-12%5.

Why Does Any of This Matter?

At the end of the day, helping patients is the main objective of developing new ophthalmic drug products. Patient need is at an all time high, as essentially all primary eye disorders are on the rise. For example, in the United States the incidence rate of diabetic retinopathy climbed an alarming 89% between 2000 and 2012, with other debilitating disease rates escalating as well9

That’s why choosing a knowledgeable partner who can work with you in overcoming development hurdles, from ever-changing FDA regulations to the intricacies of manufacturing complex dosage forms, is critical for companies to continue to support patients.

Particle Sciences is a full-service CDMO with over 20 years of experience working with complex ophthalmic drug products. We have a specialized understanding of the many challenges ocular drug delivery presents, whether it be in penetrating the corneal layers with a topical product or in targeting the retina with an intravitreal injection or drug-eluting implant. Contact us today to see how we can take your ophthalmic product from concept to commercial.

Authors: